Estate Succession: When Plans Meet Reality THE DISCLAIMER:

Do you have questions for your aging parents?

The Problem Nobody Wants to Talk About

You've done the responsible thing. You created a will. Maybe you set up a trust. You named beneficiaries. You told yourself: "That's handled."

Then life happens.

Your parent passes away, but before they do, one of your siblings dies. Your mom remarried at 65 and then again at 72. Your sibling struggles with addiction, so your parents excluded them from the will, but nobody documented why. You've been the primary caregiver for your aging parents while your brother built his career out of state. Your parents updated their estate documents last year without telling anyone. Your dad has an ex-spouse and kids from a first marriage, still named as beneficiaries because nobody thought to update it after the divorce.

These aren't edge cases. These are the scenarios GenX is managing right now with aging Baby Boomer parents. And they're complicated enough that even parents who thought they prepared everything precisely often discover their documents don't actually address what happens when life gets messy.

This issue explores three real-world succession scenarios that trip up families. The goal isn't to create anxiety—it's to create clarity. And clarity creates conversations.

What Happens When a Beneficiary Dies Before Your Parent?

The Setup: An 82-year-old woman has a will and trust that divides her estate equally between her two sons. She's confident everything is in order. Then, one son is diagnosed with terminal cancer and passes away at age 58, three years before his mother dies.

What Actually Happens: This depends entirely on how the original documents were written, specifically, whether the will or trust includes what's called a "per stirpes" distribution clause (also known as "by the branch") or a "per capita" distribution (by the head). If the documents say nothing about this scenario, the half designated for the deceased son might go to the surviving son by default, meaning one child receives the entire estate. Or it might be divided among the deceased son's children (the grandchildren). Or it could trigger probate complications that delay the entire settlement.

The Real-World Complication: If the deceased son had debt, ongoing legal issues, or an ex-spouse with claims, the grandchildren's inheritance could be encumbered or contested. If the surviving son is named as executor or trustee, he now controls assets that were intended to benefit his brother's children, creating a conflict of interest.

What To Ask Your Parents: "If one of us passes away before you do, have you specified in your will or trust what happens to that person's share? Does it go to their children, to the surviving sibling, or somewhere else? Can you show me exactly what your documents say?"

The Deceased Sibling Still on the Documents

The Setup: A 48-year-old man has an aging parent with a will and trust created 20 years ago. The documents still list the man’s brother, who died 15 years ago, as a co-executor and as a named beneficiary in certain sections. The parent's mind is still sharp, but they haven't updated their documents since their other son's death.

What Actually Happens: When the parent passes away, executors and attorneys will discover that one of the named fiduciaries is deceased. This creates legal ambiguity. Some states have laws that automatically remove a deceased executor, but others require a court order to clarify succession. The deceased brother's share becomes unclear; does it pass to his estate (and then to his beneficiaries or children), does it revert to the surviving sibling, or does it create a gap in the document that requires interpretation?

The Real-World Complication: If the deceased sibling had significant debt or unresolved legal issues, creditors might attempt to claim against his estate, which could affect the inheritance even decades after his death. If the deceased sibling had children who didn't know they were listed in the original documents, they might suddenly appear with claims to their father's share.

What To Ask Your Parents: "When was your will or trust last updated? Are there any beneficiaries or executors listed who have since passed away? If so, do you want to update those documents to reflect who's actually here now?"

The Caregiver vs. The Absent Sibling

The Setup: A 65-year-old woman has cared for her aging mother for the past eight years, managing medical appointments, finances, medications, and daily care. Her brother lives across the country, visits once a year, and has a history of financial struggles that their mother has bailed him out of multiple times. The mother's will divides the estate equally between both children, but the mother doesn't want to leave money to the brother, fearing he'll squander it. She also worries that he might claim the caregiver daughter manipulated her.

What Actually Happens: If the will is silent on this decision, both children typically inherit equally, regardless of who provided care. The caregiver receives nothing extra for their years of labor. However, if the mother dies without clear documentation of her wishes and reasoning, the brother could contest the will, claiming undue influence or that the caregiver coerced the mother into changes. Even if the contest fails, litigation costs money and time, and it fractures the family further.

The Real-World Complication: Some states allow "caregiver agreements" or documentation that protects the caregiver and clarifies the parent's intentions. But many families don't know these exist. Additionally, suppose the mother wants to exclude or reduce the brother's share without explanation. In that case, the brother has stronger legal grounds to challenge it than if the mother documented why, for example, acknowledging his financial challenges and specifying that she's making a deliberate choice not to leave him a large inheritance.

What To Ask Your Parents: "If one of us has been significantly more involved in your care, do you want that reflected in your estate plan? What's your reasoning, and how do you want that documented so there's no confusion or fighting later?"

The Pattern: What These Scenarios Have in Common

What did “they” say about assuming things. It only makes an “ass” out of “u and me.”

Each of these situations has something in common: assumptions and silence. Parents assume their documents address what happens in complex situations. They assume their children understand their intentions. They assume they'll have time to explain later. They assume nobody will fight about it.

None of these assumptions are reliable.

The antidote isn't more paperwork. It's clarity, documentation, and conversation. It's knowing why decisions were made, what actually happens if X occurs, and who's supposed to do what when the time comes.

What Comes Next: Two Companion Guides.

We've created two separate downloadable PDFs to complement this issue:

1. Estate Succession: Conversation Starters — Organized by scenario type, with multiple conversation starters for each situation. These prompts are designed to help you initiate these conversations with your parents, siblings, or trusted advisors without being accusatory or anxiety-inducing. Print it, share it, bookmark it.

2. Estate Succession: Legal Terms Guide — Explains the language you'll encounter when meeting with an estate planner. Over 60 terms organized into three sections: Estate Planning & Document Terms, Family & Relationship Terms, and Financial & Fiduciary Terms. Walk into your meeting informed and ready to ask better questions. These guides are meant to be printed, shared, or used as a reference when you're ready to have these conversations.

The Bottom Line

Estate planning isn't a one-time event. It's a conversation that evolves as your family, finances, and circumstances change. Most families never have this conversation, which is exactly why so many estates end up contested, unclear, or divided in ways the parent never intended. Your parents didn't create their estate plan to cause conflict. They created it to protect their family. But protection only works if everyone understands what's actually in the plan and why. Download the guides. Pick one scenario that resonates with your situation. Have the conversation. Get clarity.

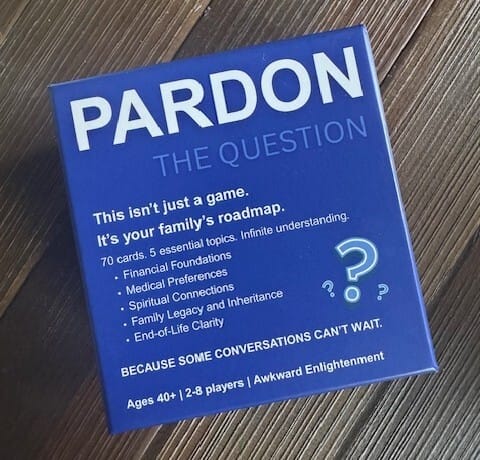

That's what "Pardon the Question" is all about.

DISCLAIMER: This newsletter is for informational purposes only and does not constitute legal advice. Estate planning involves complex legal and financial considerations that vary based on individual circumstances, state law, and family dynamics. You must consult with a qualified estate attorney or planner before making any decisions about your estate, wills, trusts, or beneficiary designations. The scenarios presented here are illustrative and do not cover all possible situations or outcomes. Ready to dig deeper? Download our companion guides: Estate Succession: Conversation Starters — Prompts for each scenario Estate Succession: Legal Terms Guide — 60+ definitions organized by category Have questions about a specific family situation? Reply to this email—we read everything, and your question might inspire our next issue.